Table Of Content

Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. 5) No mortgage insurance – As we mentioned, if you make a down payment of less than 20% of the house’s price, you will have to pay for mortgage insurance. This mortgage insurance adds to your monthly obligations, making the payment larger. Therefore, saving for a larger down payment of at least 20% can save you money in private mortgage insurance. The mortgage calculator lets you click "Compare common loan types" to view a comparison of different loan terms.

Mortgage Rates by State

However, your exact rates may vary when you apply for a mortgage loan. Homeowners insurance rates vary depending on where you live and the age and condition of the home. For instance, you may pay a higher premium for a home that’s older or hasn’t been properly maintained. When using a mortgage loan calculator, you’ll need to enter your zip code to receive an accurate estimate. For instance, if you want a lower monthly payment then you’ll want to choose a 30-year loan term.

Mortgage Calculator Calculations

Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. Mortgage lenders are required to assess your ability to repay the amount you want to borrow.

Monthly Payment: $1,687.71

Ohio Mortgage Calculator - The Motley Fool

Ohio Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

Lock in low rates currently available and save for years to come! If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the [Refinance] radio button. Adjustable-rate mortgage (ARM) loans are listed as an option in the [Loan Type] check boxes.

Is $2,000 a month too much for a mortgage?

Or instead of entering a dollar amount, enter the down payment percentage in the window to the right. A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. New mortgage lending totalled £5.2bn in the first three months of 2024, the banking group has revealed, down from £9.9bn the previous year. "Status symbol" pets are being given up by owners who get scared as they grow up, an animal charity has said, with the cost of living possibly paying a part in a rise in separations. Swap rates - which dictate how much it costs to lend money - have risen on the back of higher than expected US inflation data, and concerns this could delay interest rate cuts there. In Scotland, one can get a beautiful two-bed house for that price.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and you’ll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off. Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if you’re planning to retire early, determine how much money you need to save or invest each month and then calculate how much you’ll have leftover to dedicate to a mortgage payment.

The second step is to determine the total monthly mortgage payment. This is done by adding mortgage insurance if the minimum down payment is less than 20%, along with property taxes, homeowners insurance, and HOA Fees. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term.

California Mortgage Calculator - The Motley Fool

California Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The initial rate is typically lower than fixed rates for a set time period; once the teaser rate period ends, though, the rate will adjust and is likely to increase. A 30-year fixed-rate loan will give you the lowest monthly payment compared to shorter-term loans. Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments. Your interest rate and monthly payment will increase after the introductory period, which can be three, five, seven or even 10 years, and can climb substantially depending on the terms of your loan. In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate.

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so you’ll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. A mortgage term is the period when a mortgage is amortized—stated another way, it’s the length of time you have to pay off your mortgage. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years.

Whether you need a home loan or you want to refinance your existing loan, you can use Zillow to find a local lender who can help. These calculators are free and available online, allowing you to experiment with different scenarios and variables whenever you please. The table below breaks down an example of amortization on a $200,000 mortgage.

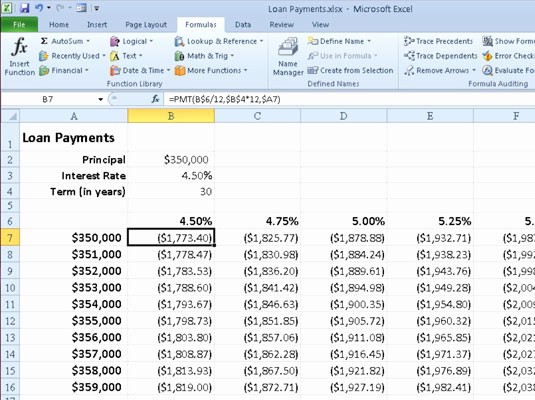

One common exemption includes, VA loans, which don’t require down payments, and FHA loans often allow as low as a 3% down payment (but do come with a version of mortgage insurance). Learn what influences taxes and insurance and how these factors can change your monthly payment. There are some special situations where a spreadsheet formula might be useful. For instance, mortgage calculators tend to assume a fixed-rate mortgage. Using the above calculator can help you put together all of these complex variables to get a clear picture of your monthly mortgage payment so you know exactly how much to expect. If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer.

No comments:

Post a Comment