Table Of Content

It also can be difficult to understand what you’re paying for—and why. When you own property, you are subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area. The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan.

Do I have to pay PMI for the life of the loan?

A lot of factors go into that assessment, and the main one is debt-to-income ratio. Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator.

Amortization Schedule

This can help you decide whether to prepay your mortgage and by how much. This is what average mortgage rates looked like as of Thursday... Stay up-to-date and compare current mortgage rates, as well as read daily analysis on the Forbes Advisor mortgage rates page. When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lender’s collateral (your home) in case of fire or other damage-causing events.

Factors That Determine Your Mortgage Payment

Closing Costs Calculator - NerdWallet

Closing Costs Calculator.

Posted: Tue, 12 Mar 2024 07:00:00 GMT [source]

Our down payment calculator can give an idea of your ideal down payment. Unexpected changes to your mortgage payment can be unsettling, especially if you don’t know why it happened. An amortization schedule shows you how much of your payment goes toward paying off principal and how much goes toward interest for any given payment you make. At the beginning of a loan, more of your payment goes toward paying interest than paying down your principal. Longer terms, like a 30-year mortgage, mean smaller payments, but more interest paid.

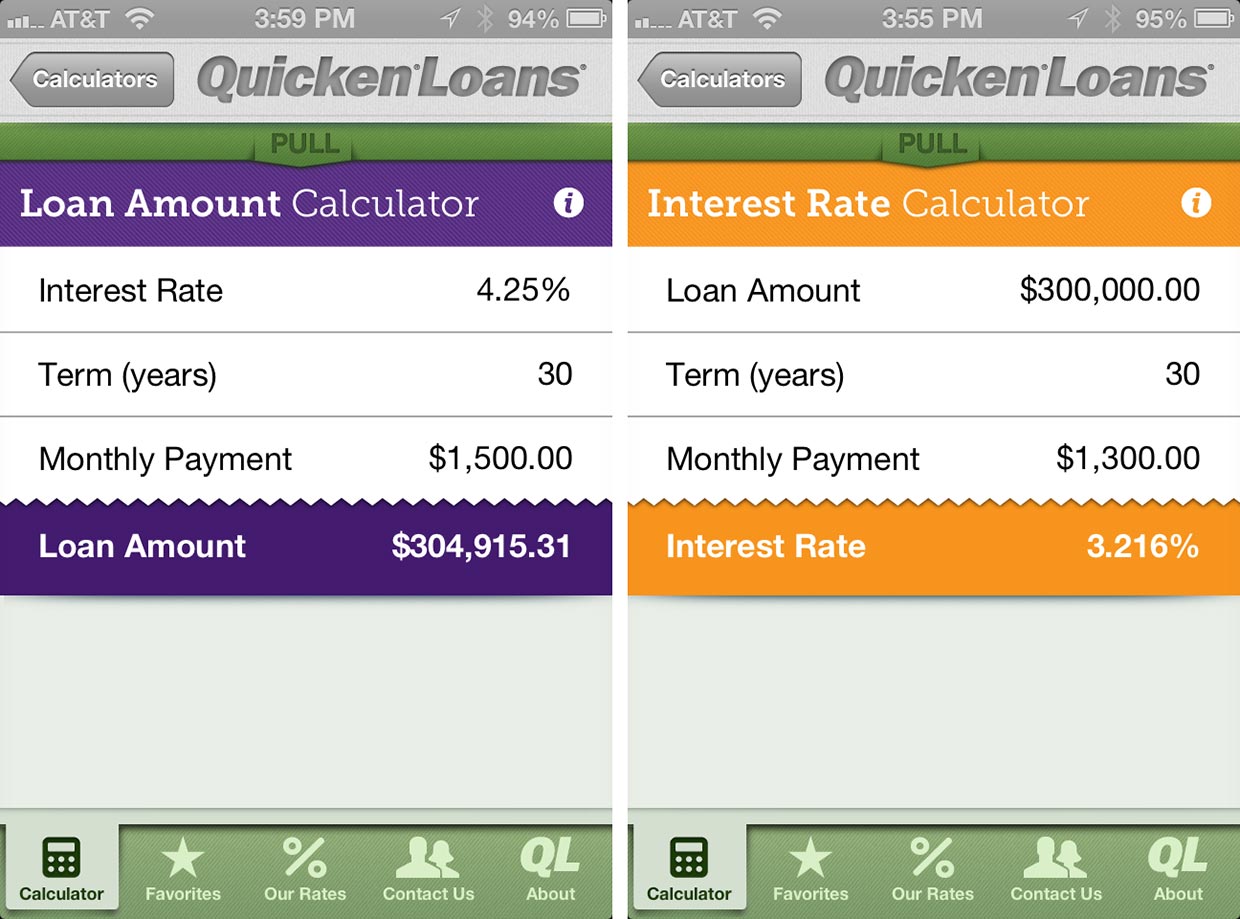

Mortgage Calculators

Then, consider how much you’ll pay in interest over the life of the loan. You can calculate your down payment as either a percentage or a flat dollar amount using the Rocket Mortgage calculator. Test out both options to get a better idea of how it will affect your home costs in the long term and the type of down payment you’ll need to bring to closing. There are several factors that determine your interest rate, including your loan type, loan amount, down payment amount and credit history. If you only plan to live in your home for a few years, ask your lender about an ARM loan.

What taxes are part of my monthly mortgage payment?

They typically begin with lower interest rates than fixed-rate loans, sometimes called teaser rates. After the initial term ends, the interest rate — and your monthly payment — increases or decreases annually based on an index, plus a margin. No Mortgage Insurance – This is one of the main advantages of VA loans compared to other non-conventional mortgages. Even with a small or no down payment, you won’t have to pay for mortgage insurance or MIP for a VA loan. This means that all else the same, VA loans would offer you a smaller monthly payment. Explore mortgage options to fit your purchasing scenario and save money.

Add All Fixed Costs and Variables to Get Your Monthly Amount

Since one year has approximately 52 weeks, with a bi-weekly mortgage payment plan, one would have to make 26 half-payments throughout the year. As you can see, with the bi-weekly payment plan, you would have to make one more monthly mortgage payment compared to the monthly payment plan. ■ Loan amount borrowed calculated by subtracting the down payment form the house price. Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment.

Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Some lenders may place caps on variable loan rates, which are maximum limits on the interest rate charged, regardless of how much the index interest rate changes. Lenders only update interest rates periodically at a frequency agreed to by the borrower, most likely disclosed in a loan contract. As a result, a change to an indexed interest rate does not necessarily mean an immediate change to a variable loan's interest rate.

Pennsylvania Mortgage Calculator - The Motley Fool

Pennsylvania Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

vs 30 Year Mortgage Payment

A mortgage calculator can help you get a realistic idea of the type of home you can afford. The Rocket Mortgage calculator estimate shows principal and interest and has the option to include estimated property tax and homeowners insurance costs, based on your zip code. A homeowners insurance premium is the cost you pay to carry homeowners insurance – a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

This can be helpful since you can pay extra on your monthly mortgage payment and have that amount applied to your loan’s principal balance. By doing so, you can pay down the principal faster to save on the interest payment. The most significant factor affecting your monthly mortgage payment is the interest rate.

The following list describes some popular ways to decrease mortgage payments. Annual MIP - The monthly payment you make using an FHA loan is also affected by the annual MIP. While for a conventional loan, you can stop paying for PMI once you reach a 20% down payment, this is not the case for FHA loans. If the mortgage rate is too high for you, you should shop around at different lenders to get the best deal. The next option is to consider mortgage discount points , as discount points can be purchased as part of closing costs to reduce your mortgage rate. 1 discount point costs 1% of the mortgage amount and reduces the mortgage rate by 0.25%.

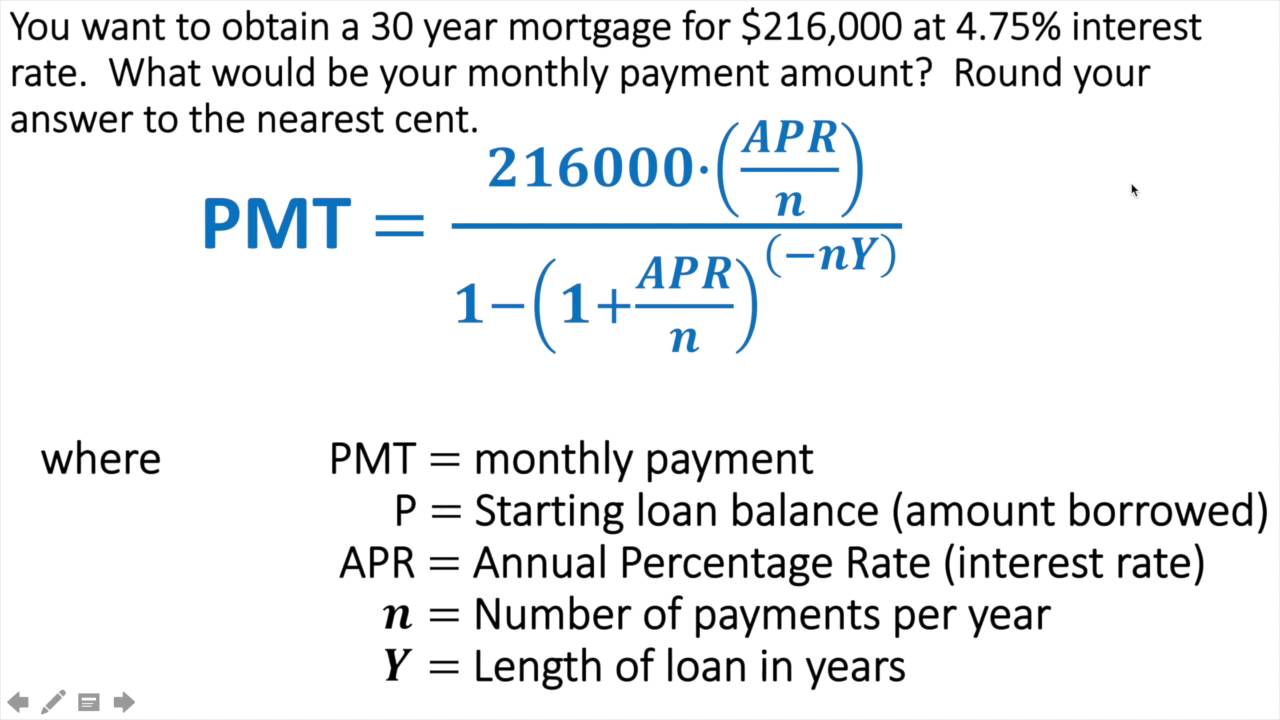

Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes, homeowners insurance & property mortgage insurance. There are many factors involved in determining a monthly house payment. You must determine the mortgage amount, or amount borrowed to purchase the house, the interest rate, the term of the loan, property taxes and homeowners' insurance. In addition, under certain circumstances, your monthly house payment will include private mortgage insurance and condominium association fees.

Private parking businesses have been accused of using misleading and confusing signs, aggressive debt collection and unreasonable fees. The cost of living crisis has also forced owners to give their pets away, she says. She added people who want to get rid of the pets sometimes call zoos for help, which then call on her charity. I think it puts too much pressure on kids who are under enough pressure at exam time. Parents should encourage their kids to do the best they can, not add to their stress levels. "They weren't more objectively successful in terms of having higher income or higher education attainment," he said.

An ARM, or adjustable rate mortgage, has an interest rate that will change after an initial fixed-rate period. In general, following the introductory period, an ARM’s interest rate will change once a year. Depending on the economic climate, your rate can increase or decrease. Want to see how much your down payment amount can affect your mortgage over time?

You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change. A mortgage is a loan secured by property, usually real estate property. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance.

No comments:

Post a Comment